This guide is for MNsure-certified brokers, navigators and certified application counselors (CACs) to help consumers report an income change using the online change report forms.

When reporting an income change online:

After you register to report changes online, log in.

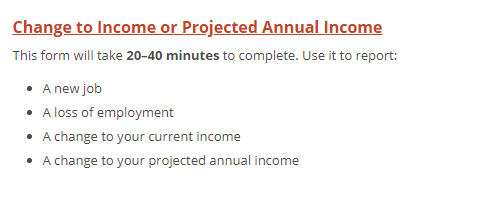

Choose the Change to Income or Projected Annual Income.

Enter the first name and last name of the consumer experiencing the change (which may or may not be the person reporting the change). Click "Continue."

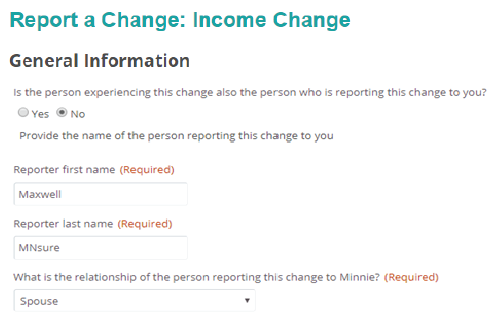

General Information

Residential Address

Enter the consumer's residential address.

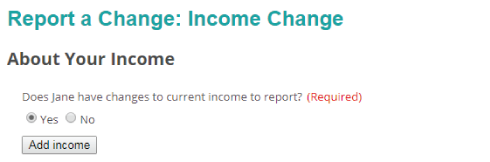

About Your Income

Answer "Yes" to the question “Does [the person] have changes to current income to report” and click the “Add income” button.

The types of income changes that can be reported are:

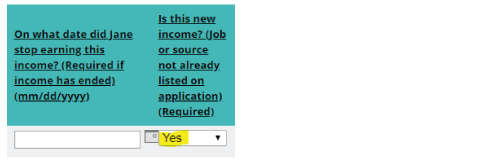

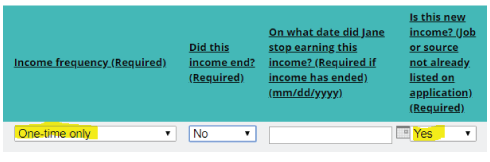

The question, “On what date did [the person] stop earning this income?” should be left blank since this is new income.

The question, “Is this new income?” should be answered “Yes.”

The question, “Income frequency (Required),” should be answered “One-time only.”

The question, “Is this new income,” should be answered “Yes.”

For example, an increase or decrease in wages at the same job.

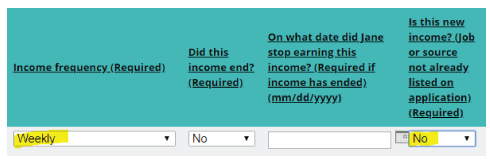

The “Income frequency” drop-down must be answered with the same frequency that is currently on the application. If the frequency on the current application is not known, it will be necessary to contact MNsure Broker Service Line or Assister Resource Center (consumer must be present) to verify this information.

The question, “Is this new income?” should be answered “No.”

First, it is necessary to end the current income that is showing on the application. If the income on the application from the previous employer is not known, it will be necessary to contact the MNsure Broker Service Line or Assister Resource Center (consumer must be present) to verify this information. Be sure to include the date for when the consumer stopped earning this income.

Then “Add” another income type to report the new income. The question, “Is this new income?” should be answered “Yes.”

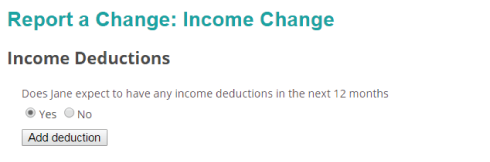

The next part of the change is used for the entry of income deductions. Select yes to add or make changes to deductions.

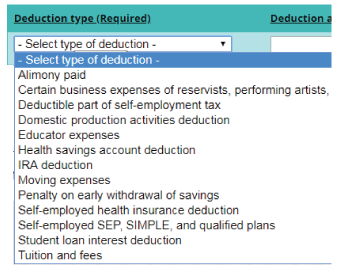

Upon selecting yes, select one of the following from the income deductions drop down:

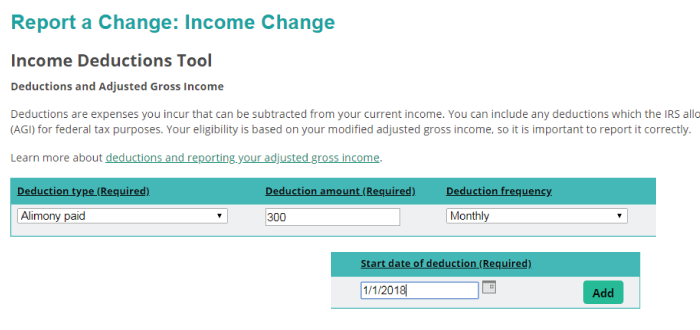

Enter the deduction amount, frequency and start date of the deduction. Then select “Add.” The screenshot below shows an example for adding an alimony paid deduction, with the deduction amount as $300, a deduction frequency as monthly and a start date as 1/1/2018.

The final questions on the income change reporting form are about projected annual income (PAI). Here you will add PAI for the consumer.

The comment field should ONLY be used to provide clarifying information. Do not use the comment field to try to report the income change information.

Once the change has been submitted an email confirmation will be sent to the email address you (the assister) used when registering to use the online change report forms.