You can adjust your APTC (advanced premium tax credit) amount during plan enrollment or any time after enrollment is complete. You can adjust it as often as you like during the month, but any change made after coverage has started is effective the first day of the next month.

If your household is enrolled in multiple medical plans, the APTC amount will be automatically divided among the eligible members and plans.

Adjusting APTC on one plan does not affect the APTC amounts on other plans. If you want to adjust APTC on multiple plans, you will need to do so on each plan, one at a time.

To apply a leftover APTC amount toward a dental plan, you must:

Example: Joan's household has $600 APTC available. Their medical plan is $550 a month. Joan and her children, who are ages 15 and 10, enroll in a medical plan first and then enroll in a dental plan. Joan can apply the left over $50 to the pediatric portion of her dental plan.

Select My Eligibility History from the dashboard navigation.

On the Eligibility Page, select View Your Plan Details.

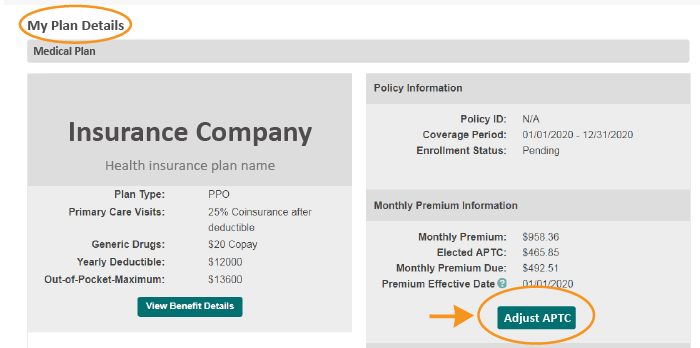

Click the Adjust APTC button on the My Plan Details page.

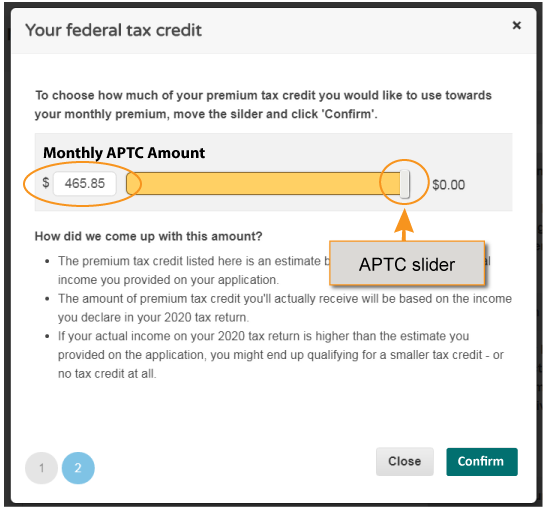

Adjust the APTC amount by moving the slider (left or right) or tapping your arrow key (up or down) to the desired amount. Click Confirm.