State Income Taxes (Form M1)

Are you uninsured? Did you miss your chance to sign up for health insurance during open enrollment?

When you do your taxes, there’s a new, easy way to ask for information from MNsure that can help you get covered.

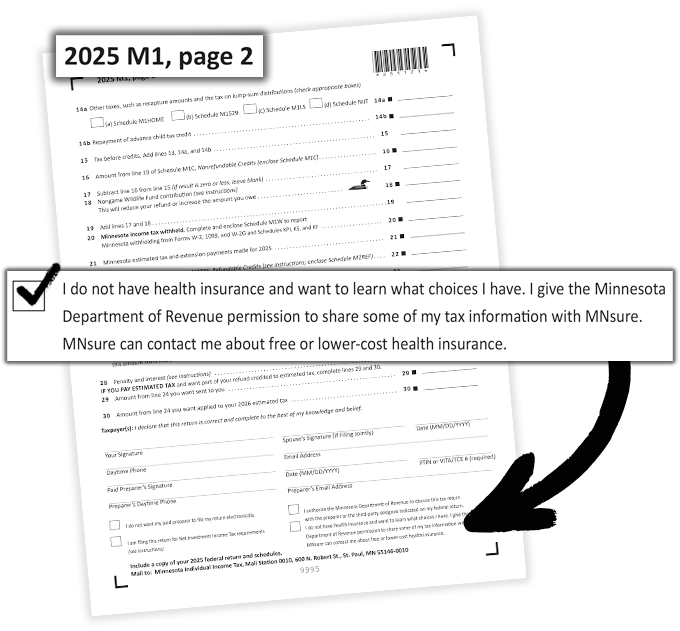

Get started by simply checking the MNsure box on your state income tax form.

Your Path to Coverage

1. Check the MNsure box on your M1. Form M1 is the individual income tax form in Minnesota.

2. File your taxes.

3. Get a letter from MNsure.

4. Apply online.

- If you're eligible for Medical Assistance or MinnesotaCare: The Minnesota Department of Human Services will mail you information about your plan options.

- If you're eligible for a private health plan: You have 65 days from the date on MNsure's letter to enroll in a private plan.

Check the Box to Open Your Special Enrollment Period

If you check the MNsure box on your M1 and you're eligible to enroll, we'll open a special enrollment period for you. You don’t have to wait until the next open enrollment period to get covered!

Easy access to information

After you file your taxes, watch the mail. We'll send you a letter about coverage options — including free or low-cost health insurance — and how to apply.

See if you qualify for savings

Three out of four Minnesotans without health insurance are eligible for financial help through MNsure. Fill out an application to see what you qualify for.

You’ll have 65 days to enroll in coverage

If you’re eligible, you will have 65 days to sign up and select a private plan.

Get Free Help

- Use our Assister Directory to find a MNsure-certified broker or navigator near you

- No English? Call 651-539-2099 or 855-366-7873 for help

Common Questions

If I check the box, do I have to enroll in insurance?

No. There’s no obligation to apply or enroll.

Why can't I just apply at MNsure.org without checking the box on my tax form?

MNsure’s annual open enrollment period runs between November 1 and January 15 of each year. Outside of open enrollment, most people will need a major life change (like getting married, having a baby or losing other health insurance) or must meet certain income limits to enroll.

This is another time-limited chance to enroll — but only if you check the MNsure box on your Form M1 when you file your taxes.

How long do I have to apply through MNsure?

The letter from MNsure has the end date for your special enrollment period. Don’t wait to call MNsure to apply — if you’re eligible for a private plan, you have just 65 days to enroll.

If you’re eligible for Medical Assistance or MinnesotaCare, you can enroll any time of year and you don’t need a special enrollment period.

I’m a tax professional — what do I need to know?

Ask your client if they have health insurance and help them check the MNsure box on the Form M1 to request information. After they file their taxes, they will receive a letter from MNsure about coverage options and next steps.

Note: Checking the MNsure box is not the same as applying for health coverage. Your client must fill out an application to see what they qualify for.